Canada's Air Force actively defends the country's sovereignty by conducting surveillance patrols within our boundaries, and well out into the Atlantic, Pacific and Arctic oceans. CP-140 Aurora aircraft work closely with government departments and other agencies to combat drug smuggling and illegal immigration, monitor for ships discharging pollutants, track fishing vessels, and report on ice flows and formations. Auroras and their crews operate from squadrons based on the East and West Coasts, where they also provide Search and Rescue (SAR) capabilities. The CP-140 is a unique aircraft because of its range and the different sensors that we have onboard. It was originally designed to locate Soviet submarines during the Cold War, but it's much more capable than that. We have the type of mission we're doing today, to locate all commercial vessels and any drug smugglers, polluters, that come into Canadian waters. We can support the RCMP for drug operations, things like that. Also now, we're moving it to overland operations, supporting the Army. Some of the sensors that we have are ideal for doing surveillance for them, locating like Beds or enemy ground troops and the like, and our endurance is one of our biggest factors. We can stay aloft anywhere between 10 and 15 hours, and sometimes even more, so that gives us the staying power for anybody that needs us out there, and we're being able to work with the Army and work with the Navy.

PDF editing your way

Complete or edit your tbs sct 330 23e anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export tbs 330 23e directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your tbs 330 23 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 330 23e form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Canada TBS/SCT 330-23e 2025 Form

About Canada TBS/SCT 330-23e 2025 Form

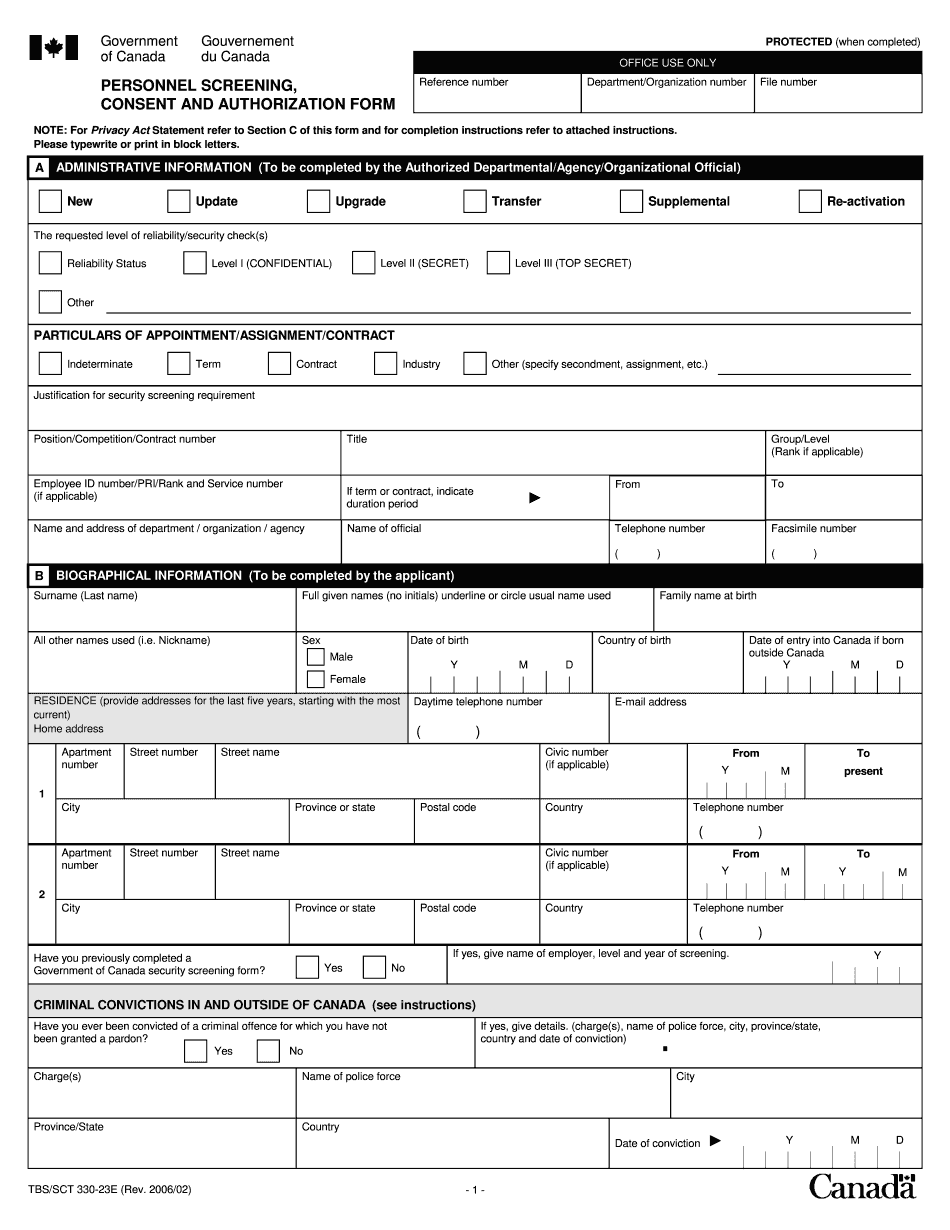

The Canada TBS/SCT 330-23e 2025 Form is a document provided by the Treasury Board of Canada Secretariat (TBS) for the purpose of gathering information on contracts for assessment and reporting requirements. It is primarily used by federal government departments and agencies in Canada. This form is required to be completed by government officials responsible for managing procurement activities and awarding contracts. It helps them collect and report essential information about the contract, such as its value, the supplier's details, and the description of the goods or services acquired. By completing the TBS/SCT 330-23e Form, the government aims to ensure transparency and accountability in procurement practices and to support overall procurement planning and analysis. It should be noted that while this information is accurate as of 2021, it is advisable to consult the official sources or the Treasury Board of Canada Secretariat for any updates or specific requirements related to this form.

Online alternatives enable you to manage your file operations and improve the output of your respective workflow. Follow the quick guide in order to complete Canada TBS/SET 330-23e 2025 Tbs Sct 330 23e, avoid errors and supply the idea promptly:

How to finish a Canada TBS/SET 330-23e 2025 Tbs Sct 330 23e online:

- On the web site with all the file, simply click Begin immediately along with complete towards the manager.

- Use the hints for you to fill in the relevant fields.

- Add your personal data and speak to files.

- Make certain you enter proper information and also quantities within correct areas.

- Wisely confirm the written content from the PDF along with grammar and punctuation.

- Go to Support segment when you have any questions as well as deal with the Support group.

- Place an electric unique in your Canada TBS/SET 330-23e 2025 Tbs Sct 330 23e with the help of Signal Device.

- When the form is finished, media Accomplished.

- Share your all set document through email or perhaps facsimile, produce out or reduce your own system.

PDF manager allows you to help make adjustments for your Canada TBS/SET 330-23e 2025 Tbs Sct 330 23e from the internet related system, personalize it in accordance with the needs you have, sign that electronically as well as deliver in another way.

What people say about us

Digitally preparing forms in the new arena of remote work

Video instructions and help with filling out and completing Canada TBS/SCT 330-23e 2025 Form